Getting My Pacific Prime To Work

Getting My Pacific Prime To Work

Blog Article

The smart Trick of Pacific Prime That Nobody is Discussing

Table of ContentsSome Ideas on Pacific Prime You Need To KnowSome Known Questions About Pacific Prime.Pacific Prime for BeginnersSome Ideas on Pacific Prime You Need To KnowPacific Prime for Dummies

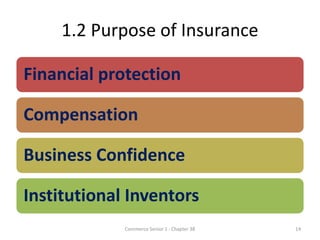

Your agent is an insurance policy specialist with the expertise to lead you with the insurance policy procedure and aid you discover the most effective insurance coverage security for you and individuals and things you respect a lot of. This post is for informative and idea functions just. If the policy coverage descriptions in this short article dispute with the language in the plan, the language in the policy applies.

Policyholder's fatalities can additionally be contingencies, specifically when they are thought about to be a wrongful death, as well as residential property damage and/or destruction. Because of the uncertainty of said losses, they are labeled as contingencies. The insured individual or life pays a premium in order to receive the advantages promised by the insurance provider.

Your home insurance policy can assist you cover the problems to your home and afford the expense of restoring or fixings. Often, you can likewise have protection for items or prized possessions in your home, which you can after that buy replacements for with the cash the insurance business provides you. In case of an unfavorable or wrongful fatality of a sole earner, a household's economic loss can potentially be covered by particular insurance coverage plans.

4 Easy Facts About Pacific Prime Shown

There are various insurance policy intends that consist of cost savings and/or investment systems along with regular protection. These can assist with structure savings and wide range for future generations via routine or reoccuring investments. Insurance can assist your household maintain their standard of living in the occasion that you are not there in the future.

One of the most fundamental form for this sort of insurance policy, life insurance policy, is term insurance coverage. Life insurance policy as a whole assists your household become safe monetarily with a payment amount that is offered in the occasion of your, or the plan owner's, fatality throughout a details policy duration. Kid Strategies This type of insurance policy is primarily a cost savings tool that helps with generating funds when youngsters reach particular ages for going after greater education and learning.

Home Insurance coverage This type of insurance covers home problems in the cases of accidents, all-natural catastrophes, and accidents, along with other comparable occasions. global health insurance. If you are wanting to look for compensation for mishaps that have occurred and you are battling to find out the proper path for you, reach out to us at Duffy & Duffy Law Practice

The Of Pacific Prime

At our law company, we recognize that you are experiencing a great deal, and we understand that if you are pertaining to us that you have been with a whole lot. https://experiment.com/users/pacificpr1me. As a result of that, we provide you a cost-free appointment to look at your concerns and see just how we can best assist you

Due to the fact that of the COVID pandemic, court systems have been closed, which adversely influences auto accident instances in a significant method. Again, we are here to assist you! We proudly serve the people of Suffolk Area and Nassau County.

An insurance coverage plan is a lawful contract between the insurance policy firm (the insurer) and the individual(s), organization, or entity being insured (the insured). Reviewing your plan aids you verify that the plan fulfills your needs which you recognize your and the insurance provider's duties if a loss happens. Several insureds purchase a plan without understanding what is covered, the exemptions that remove protection, and the conditions that must be met in order for insurance coverage to apply when a loss occurs.

It identifies that is the guaranteed, what threats or residential property are covered, the plan restrictions, and the policy period (i.e. time the policy is in pressure). For example, the Declarations Web page of an automobile article plan will include the description of the vehicle covered (e.g. make/model, VIN number), the name of the person covered, the premium amount, and the deductible (the amount you will have to spend for an insurance claim prior to an insurer pays its part of a covered claim). The Declarations Page of a life insurance policy will certainly consist of the name of the individual insured and the face amount of the life insurance policy (e.g.

This is a recap of the significant guarantees of the insurer and mentions what is covered. In the Insuring Arrangement, the insurance firm agrees to do certain points such as paying losses for protected hazards, giving specific solutions, or agreeing to safeguard the insured in a liability claim. There are 2 standard types of a guaranteeing agreement: Namedperils insurance coverage, under which just those dangers especially noted in the plan are covered.

Pacific Prime Can Be Fun For Anyone

Life insurance plans are normally all-risk plans. https://canvas.instructure.com/eportfolios/2829699/Home/Pacific_Prime_Your_Ultimate_Destination_for_Insurance_Solutions. The three significant types of Exclusions are: Left out perils or reasons of lossExcluded lossesExcluded propertyTypical examples of excluded dangers under a house owners policy are.

Report this page